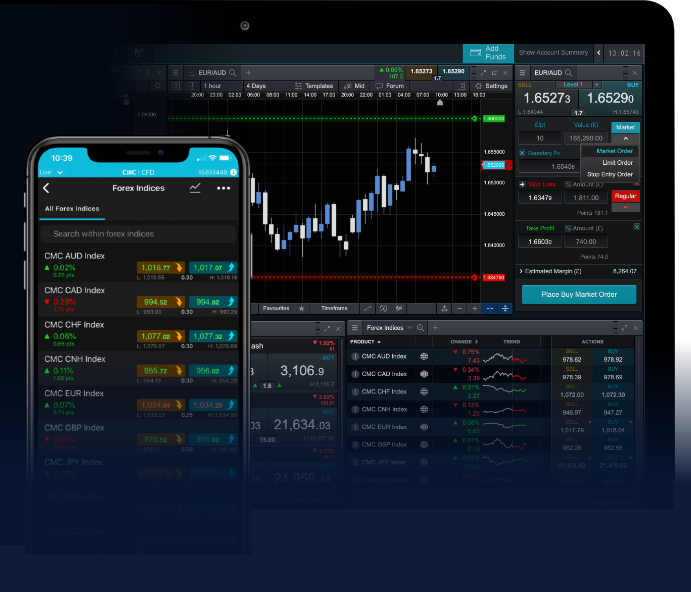

Forex trading charts are essential tools for traders who wish to analyze price movements and make informed decisions. These charts provide a visual representation of currency pairs over time, helping traders identify trends, potential entry and exit points, and trading strategies. To begin mastering forex trading, familiarizing oneself with these charts is crucial. For a deeper dive into forex trading and resources, visit forex trading charts https://forex-exregister.com/.

What are Forex Trading Charts?

Forex trading charts are graphical representations of currency pair price movements over a specified time frame. These charts allow traders to observe price trends, support and resistance levels, and potential market reversals. By interpreting these charts, traders can make informed decisions on when to enter or exit trades.

Types of Forex Trading Charts

There are three primary types of forex trading charts: line charts, bar charts, and candlestick charts. Each type has unique features and benefits, making them suitable for different trading styles and strategies.

1. Line Charts

Line charts are the simplest form of forex charts. They connect closing prices with a continuous line, providing a clear view of price movements over time. This type of chart is useful for identifying trends and general price direction, making it ideal for long-term traders. However, line charts lack detailed information about price fluctuations within the time frame, and therefore may not be suitable for those who require precise entry and exit points.

2. Bar Charts

Bar charts offer more information than line charts. Each bar represents a specific time period and displays the opening, closing, high, and low prices within that period. This allows traders to gauge price volatility and understand market sentiment. The vertical line represents the price range, while the horizontal ticks on the left and right side denote the opening and closing prices respectively. Bar charts are valuable for both short-term and long-term traders looking to capture more detailed price movements.

3. Candlestick Charts

Candlestick charts are a favorite among forex traders due to their visual appeal and the wealth of information they convey. Each candlestick represents a specific time frame, displaying the open, close, high, and low prices. The body of the candlestick shows the price range between the opening and closing prices, while the wicks (or shadows) indicate the highest and lowest prices during the time frame. A green (or white) candlestick signifies a bullish trend, while a red (or black) candlestick indicates a bearish trend. Candlestick patterns can be used to predict future price movements, making this chart type especially useful for day traders and scalpers.

Understanding Time Frames

Different trading styles require different time frames for analysis. Time frames can range from one minute to several weeks or even months, depending on the trader’s strategy:

- Short-term trading: Traders often use 1-minute to 15-minute charts for scalping and day trading.

- Medium-term trading: Strategies may involve 30-minute to 4-hour charts, suitable for swing traders.

- Long-term trading: Daily or weekly charts help position traders to capture larger trends over time.

Technical Analysis and Patterns

Technical analysis involves studying historical price data represented on forex charts to forecast future price movements. Traders use various indicators and patterns to make sense of the chart data. Some popular indicators include:

- Moving Averages: These indicators smooth price data to identify trends over a specific period.

- Bollinger Bands: These bands help assess market volatility and identify potential price reversals.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements, indicating overbought or oversold conditions.

Apart from indicators, traders often look for specific chart patterns that signal potential market reversals or continuations. These patterns include head and shoulders, double tops, triangles, and flags.

Using Forex Trading Charts in Strategy Development

Regardless of the trading style, integrating forex trading charts into one’s strategy is essential for success. By analyzing charts, traders can develop strategies tailored to market conditions. For example:

- Trend Following: Identifying and trading in the direction of established trends using moving averages or trendlines.

- Reversal Trading: Looking for chart patterns like head and shoulders or double tops to anticipate price reversals.

- Breakout Trading: Monitoring support and resistance levels to enter trades when the price breaks through significant barriers.

Risk Management and Discipline

While forex trading charts offer valuable insights, successful trading involves more than just analysis. Effective risk management and discipline are crucial components. Setting stop-loss orders, determining position sizes based on account risk, and sticking to a trading plan can help protect traders from significant losses. Additionally, maintaining a trading journal to review past trades and learning from mistakes can significantly improve a trader’s skill over time.

Conclusion

Mastering forex trading charts is an essential skill for any trader seeking to understand market dynamics and make informed trading decisions. By familiarizing oneself with different chart types, time frames, and technical analysis techniques, traders can enhance their ability to predict price movements effectively. Ultimately, combining chart analysis with solid risk management and discipline can lead to long-term success in forex trading. Start your journey with forex trading charts today, and discover the potential they hold for your trading strategy!